THE MARKET FOR OUR PRODUCTS

The demand for our primary product, nickel sulphate, will increase dramatically over the next two decades. This increase in demand is based on two factors:

- The electrification of the automobile industry

- The trend for nickel intensive lithium-ion batteries to dominate the supply of power to electric vehicles

The electrification of the automobile industry

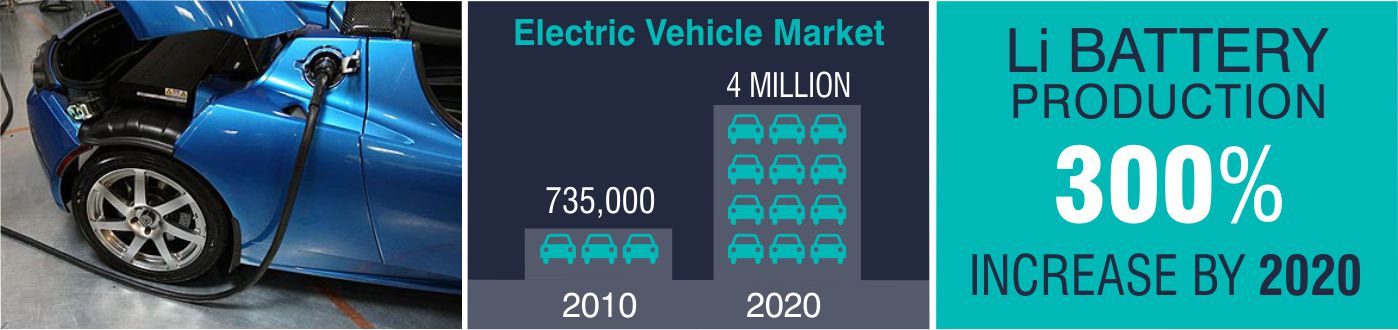

There is no doubt the electrification of the automobile industry is gathering momentum driven by a combination of consumer demand for a cleaner environment, government policies, and falling lithium-ion battery prices.

Multiple reports predict that the production of electric vehicles (EVs) will continue to grow. The predictions in the increase in the size of the EV market vary – but they vary from a steady growth to exponential growth. UBS is forecasting a twenty-fold increase in global vehicle sales to 15 million units (both electric vehicles and plug-in hybrid electric vehicles) by 2025 (Financial Review – August 9, 2017). A report by Dutch bank ING, predicts electric vehicles will become the new normal in Europe within just two decades (Business Insider July 14, 2017). Last year China sold 507,000 electric vehicles including buses and commercial vehicles, but Beijing has set a target to manufacture seven million battery cars and hybrid vehicles by 2025. (Financial Review October 12, 2017).

An important catalyst for EV sales is government policy. Historically some governments have improved the value proposition around EVs by providing generous subsidies to car buyers. But now regulations are being taken to a new level by setting end-dates for the sale of combustion engines, examples include:

- Norway – new passenger cars and vans must have zero emissions by 2025

- India – will ban the sale of new gasoline and diesel cars by 2030

- UK – will ban the sale of new gasoline and diesel cars by 2040

- France – will ban the sale of new gasoline and diesel cars by 2040

- China – recently announced it will ban the sale of gasoline and diesel cars (official date still pending).” (Barron’s Asia October 11, 2017)

The trend for nickel intensive lithium-ion batteries to dominate the supply of power to electric vehicles

There are competing lithium-ion technologies. Currently in China most EVs use lithium-ion phosphate batteries that have no nickel, but Chinese manufactures are rapidly moving in line with the rest of the world, which predominantly utilises nickel cathodes such as Nickel Cobalt Manganese (NCM) or Nickel Cobalt Aluminium (NCA). In a research paper for AFC, LUX Research predicts NCM and NCA batteries will make up 85% of battery cathodes by 2025. The UBS research has NCM and NCA at close to 100% of the market by 2025.

At its simplest, the reason nickel rich battery technologies are winning is because they best balance the trade-off between performance and cost. At a more technical level the energy density of the battery (as measured by watt- hour per kilogram Wh/kg) improves as more nickel is added because nickel is a highly electrochemically active cathode element. More power – less weight.

The result

Demand for nickel (i.e. nickel sulphate) in lithium-ion batteries for the electric vehicle market is expected to grow very strongly – it is more a question of how high the demand will be and how quickly it will all happen. Because of the inherent uncertainties in such projections there is a wide range in the estimates of nickel consumption in the switch to electric vehicles.

To illustrate, UBS has projected nickel consumption by 2025 of 580,000 tonnes of contained nickel which equates to 2.6million tonnes of nickel sulphate. Goldman Sachs has projected increased demand at between 200,000 and 300,000 tonnes of contained nickel equating to 900,000 to 1,350,000 tonnes of nickel sulphate.